In december 2015 congress enacted a five year extension of renewable energy tax credits for solar and other renewable energy technologies as part of an omnibus spending bill.

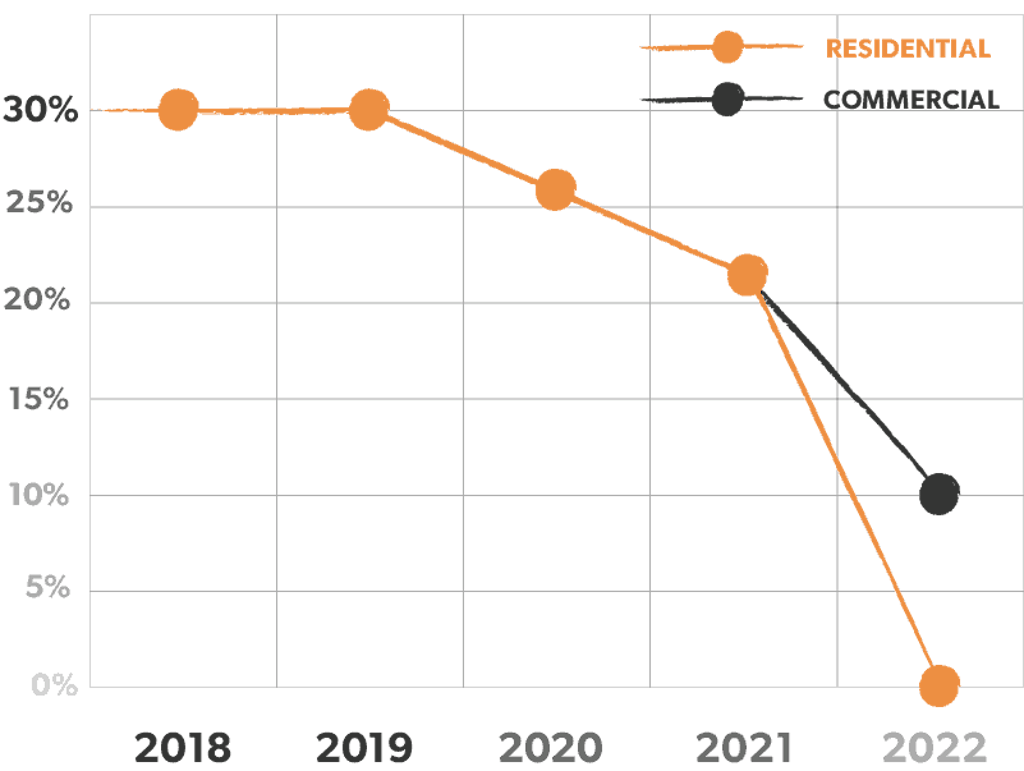

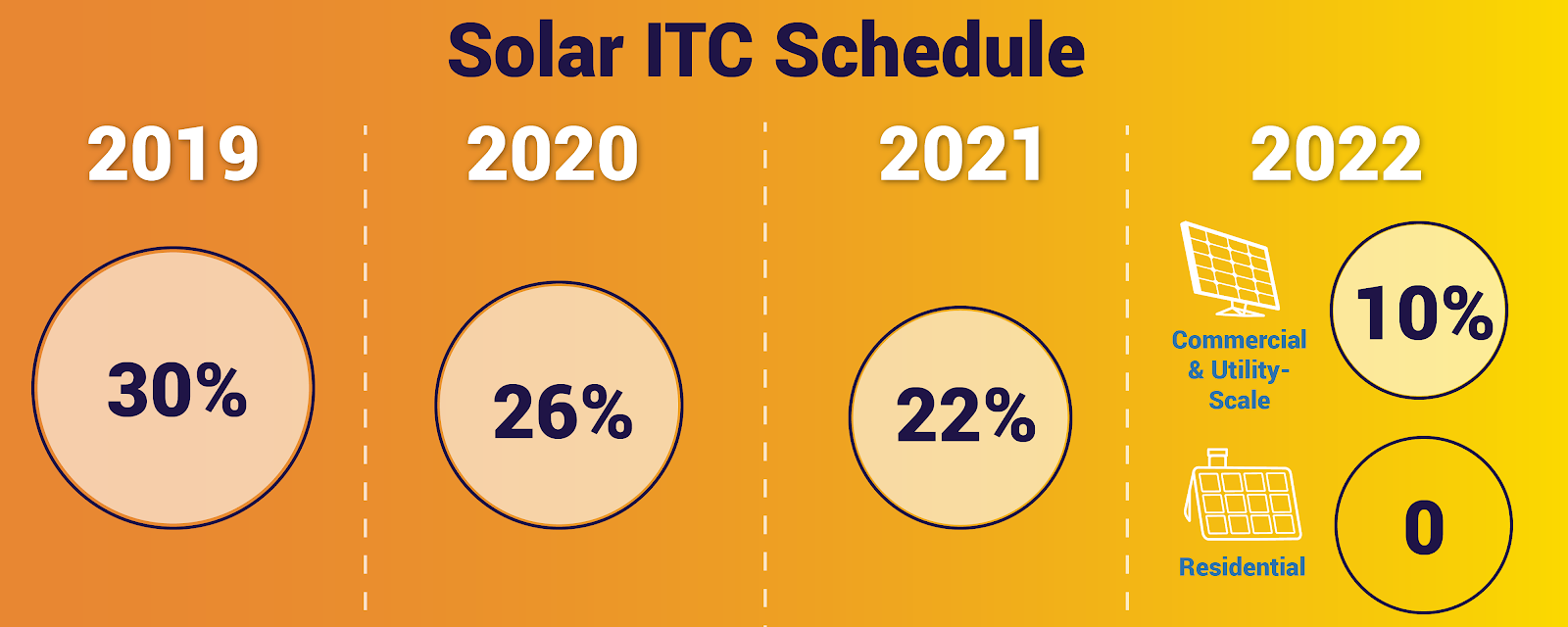

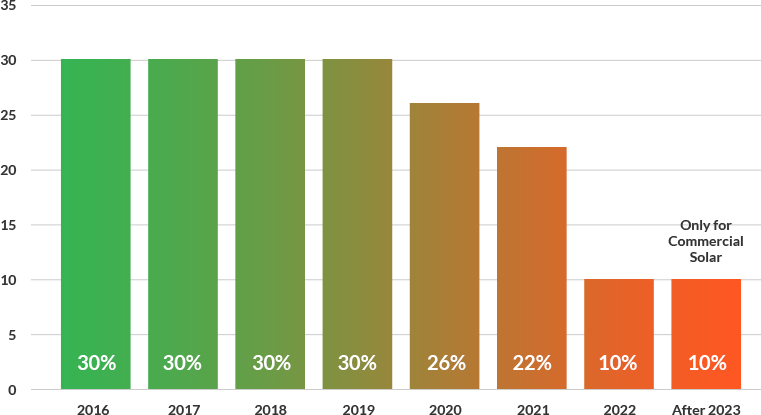

Solar itc phase out schedule.

Congress agreed on a bill that extends the solar investment tax credit itc by five additional years as part of a 1 15 trillion spending bill.

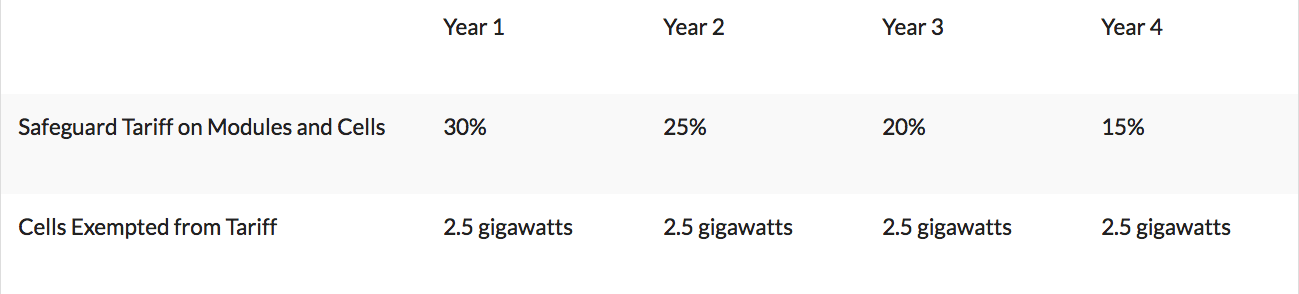

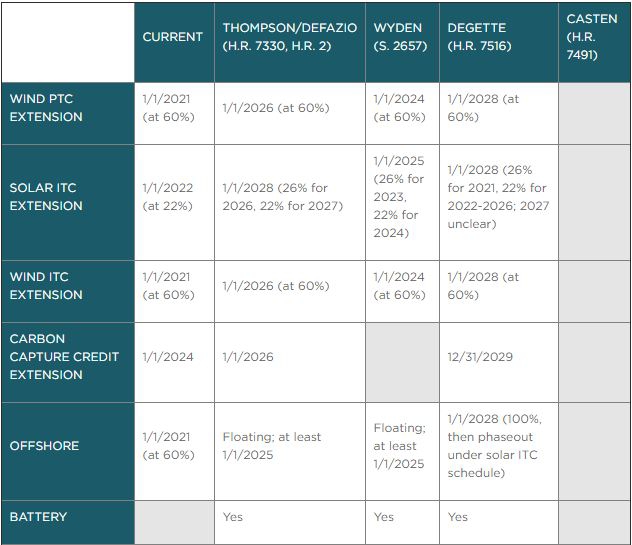

The bipartisan budget act of 2018 modified section 48 by retroactively extending the itc for certain other renewable energy property for which construction begins before jan.

The itc and ptc extension dates back to 2015.

Economy in the.

Projects that start.

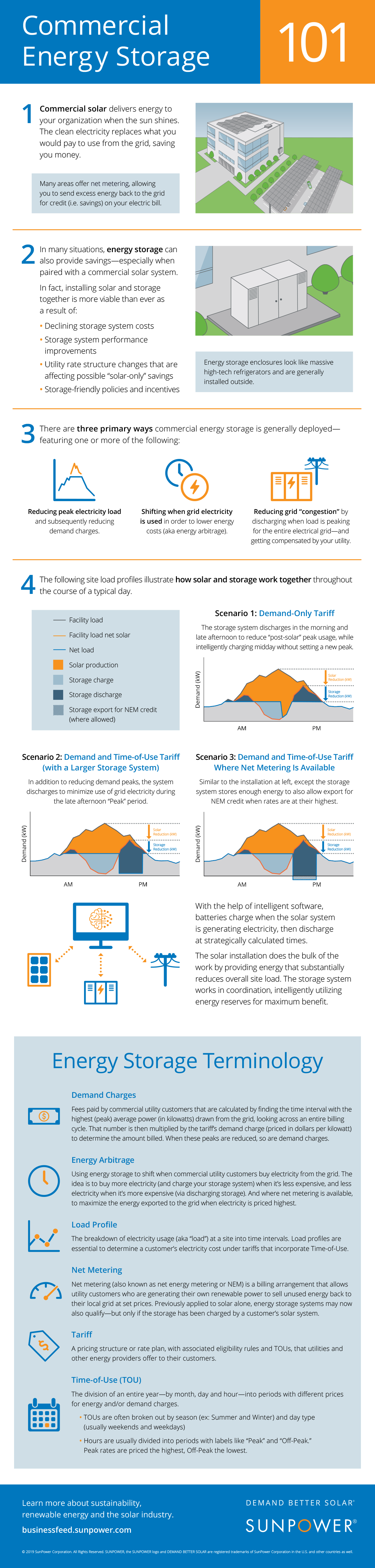

Since the investment tax credit is applied to your solar array s gross system cost the amount you receive is dependent on the amount of solar you re purchasing.

The federal solar tax credit also known as the investment tax credit itc allows you to deduct 26 percent of the cost of installing a solar energy system from your federal taxes.

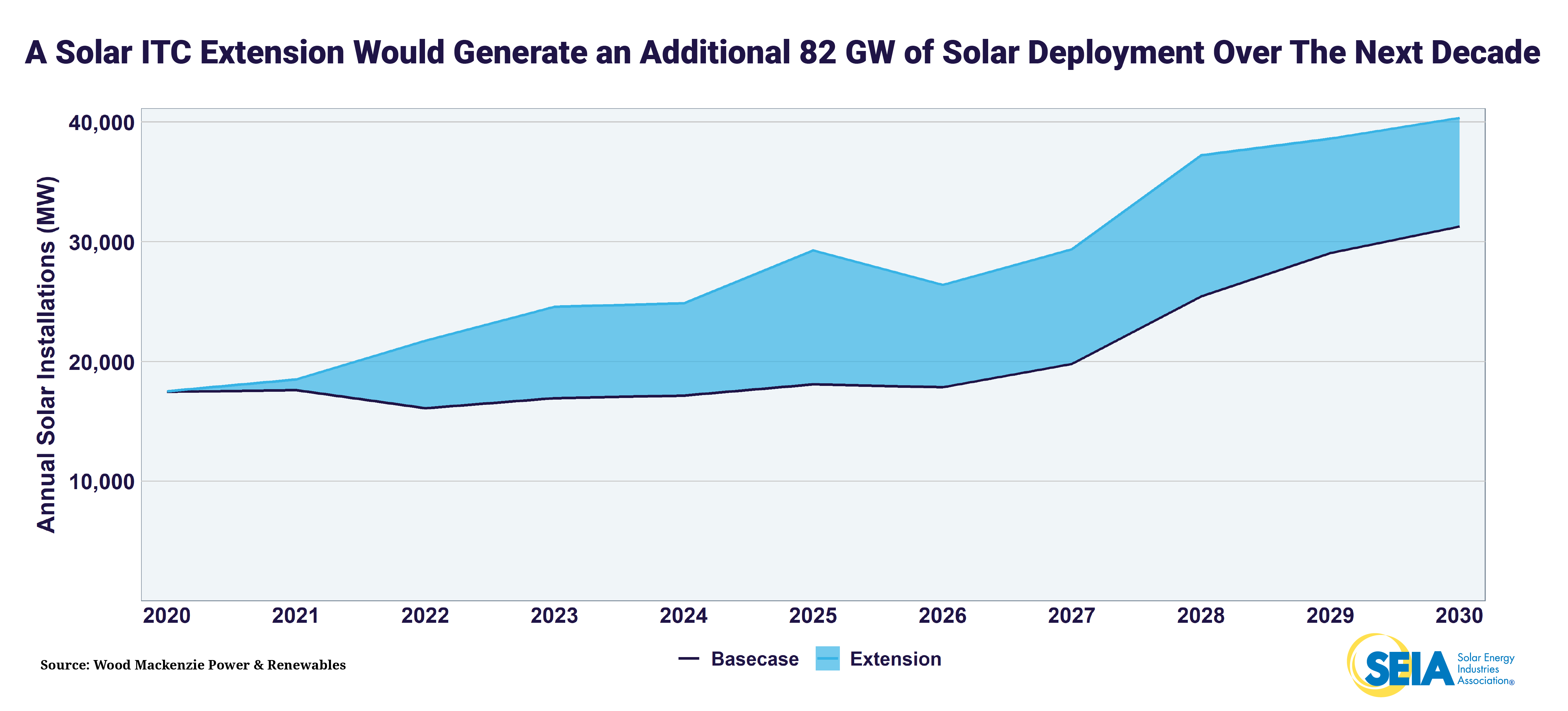

The itc will be extended from dec.

Solar industry has grown by more than 10 000 creating hundreds of thousands of jobs and investing billions of dollars in the u s.

The solar investment tax credit itc is one of the most important federal policy mechanisms to support the growth of solar energy in the united states.

31 2016 and instead stepped down from 30 to 10 until 2024.

His company s research has shown that the itc s phase out schedule is expected to remain intact.

As summarized by research firm ihs key details of the extension include.

The itc applies to both residential and commercial systems and there is no cap on its value.

Bigger system bigger credit.