The federal solar tax credit also known as the investment tax credit itc allows you to deduct 26 percent of the cost of installing a solar energy system from your federal taxes.

Solar itc phase out.

Economy in the.

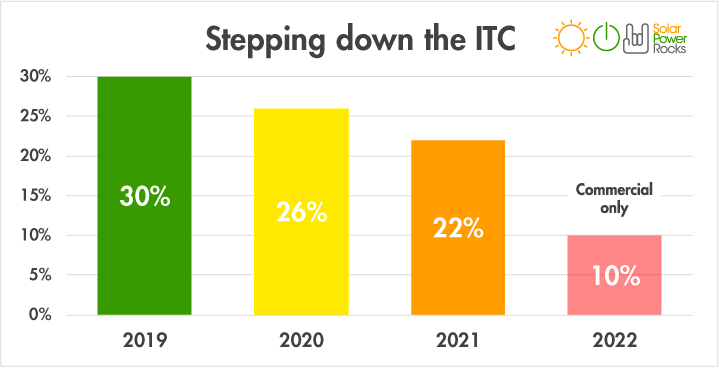

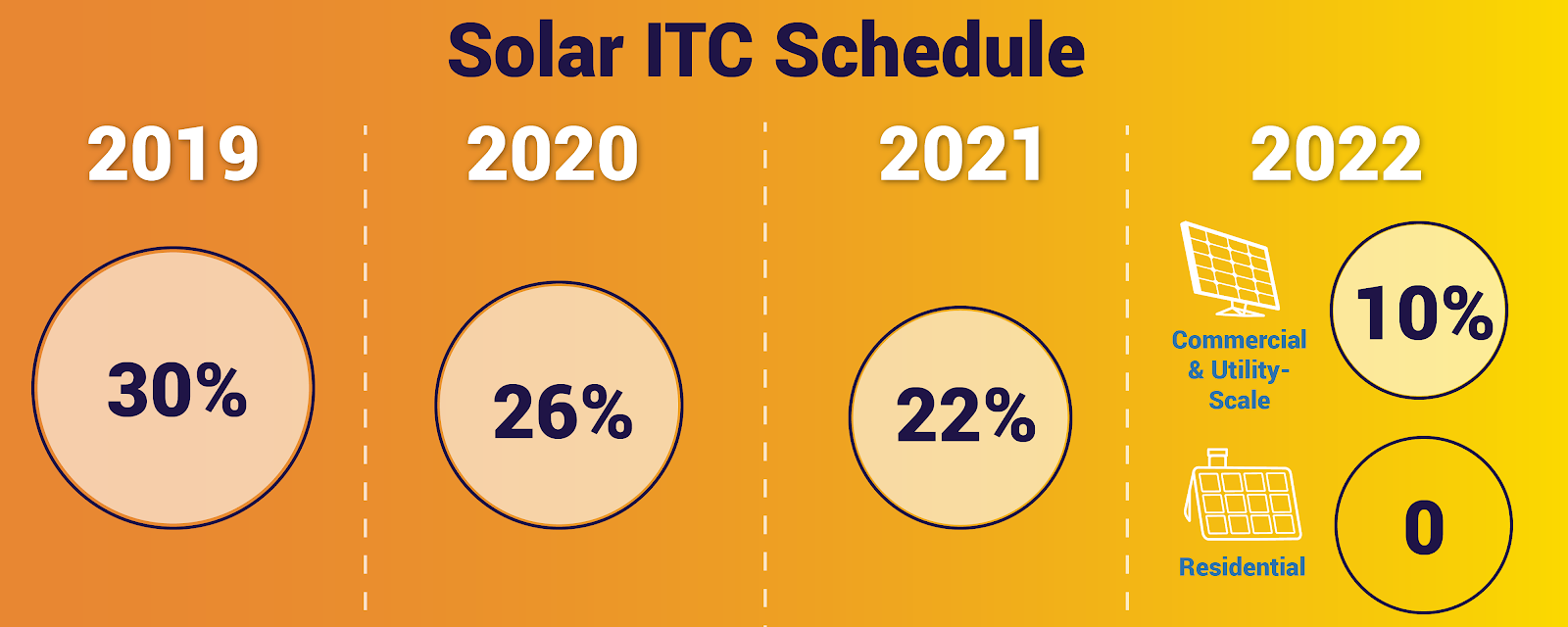

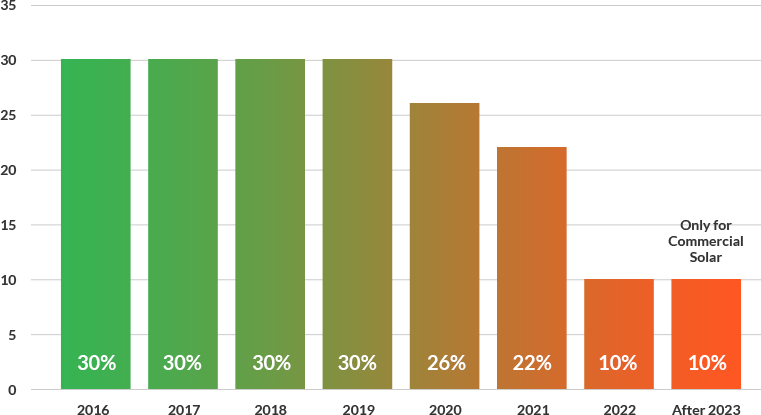

With the first phase out of the itc set to drop the credit from 30 to 26 after december 31 2019 many taxpayers are evaluating ways to make sure their project still qualifies for the 30 credit.

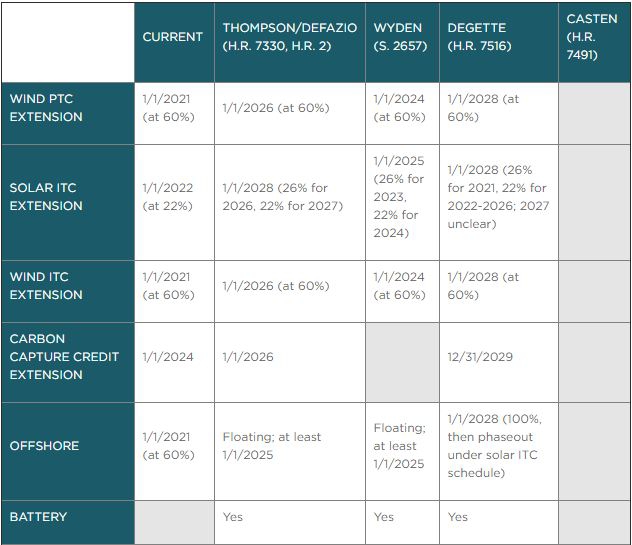

1 2022 and further limits the credit for solar energy property not placed in service before jan.

31 2019 and before jan.

As of 2020 the itc has begun to decline.

With the first phase out of the itc set to drop the credit from 30 to 26 after december 31 2019 many taxpayers are evaluating ways to make sure their project still qualifies for the 30 credit.

Owners of new residential and commercial solar can deduct 26 percent of the cost of the system from their taxes.

The itc applies to both residential and commercial systems and there is no cap on its value.

The investment tax credit currently a credit of 26 percent of the cost of your solar or solar storage installation.

It received a multi year extension in 2015 which provides business certainty to project developers and investors.

Solar industry has grown by more than 10 000 creating hundreds of thousands of jobs and investing billions of dollars in the u s.

The consolidated appropriations act fof 2016 extended and modified section 48 itc to phase down the itc rage for solar energy property for which construction begins after dec.

The itc phase out may also lead to reduced financing costs as the need for separate tax equity investments for financing solar projects requires complex deal structures and due diligence.

By 2022 residential solar systems won t be eligible for this credit at all.

It will remain at 30 for residential consumers until the end of 2019 so you re running out of time to take advantage of the full credit.

Since the itc was enacted in 2006 the u s.

Starting january 1 2020 the solar carve out will begin to phase out and will return to 10 by january 1 2024.

The federal government is gradually going to phase out the solar tax credit.

Here s how the incentive will sunset over the coming years.

Starting january 1 2020 the solar carve out will begin to phase out and will return to 10 by january 1 2024.

The cost of solar power purchase agreements ppas could increase as the investment tax credit steps down over the next five years.

The itc continues to drive growth in the industry and job creation across the country.

Pv systems a similar tax credit phase out applies until december 31 2021 after which the tax credit scheme ends.

By 2020 it ll be worth 26 then 22 in 2021.

The itc was in danger of expiring in 2015.